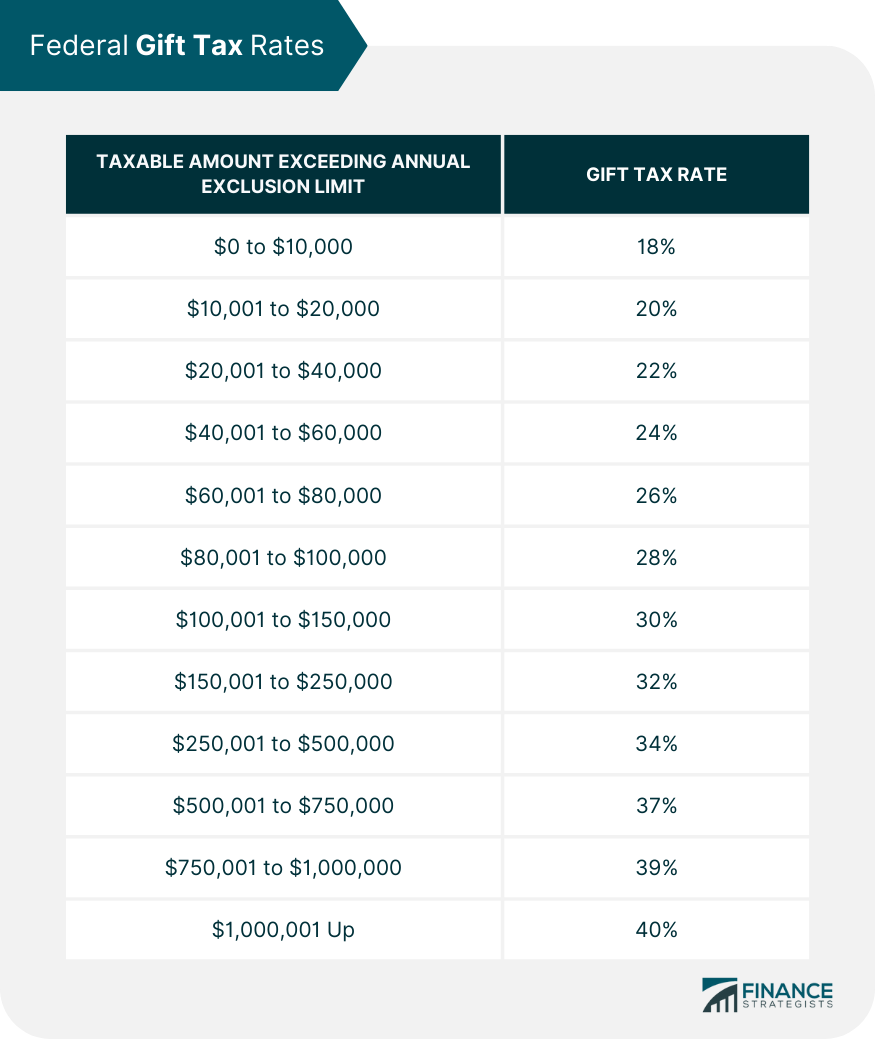

Gift Tax Rate Table 2025. The federal estate tax applies to the transfer of property at death. Elevated gift tax exclusions will sunset after 2025.

2025 exemption does not reflect a. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, If congress doesn't act, the estate tax exemption will sunset at the end of 2025.

T200018 Baseline Distribution of and Federal Taxes, All Tax, The federal estate tax applies to the transfer of property at death.

Irs Tax Tables 2025 Married Jointly Caril Cortney, At that time, the exemption will drop to a base of $5 million (adjusted for inflation) in 2026.

Gift Tax Rates 2025 Heather Mitchell, The lifetime gift/estate tax exemption is $13.61 million in 2025 and 2025.

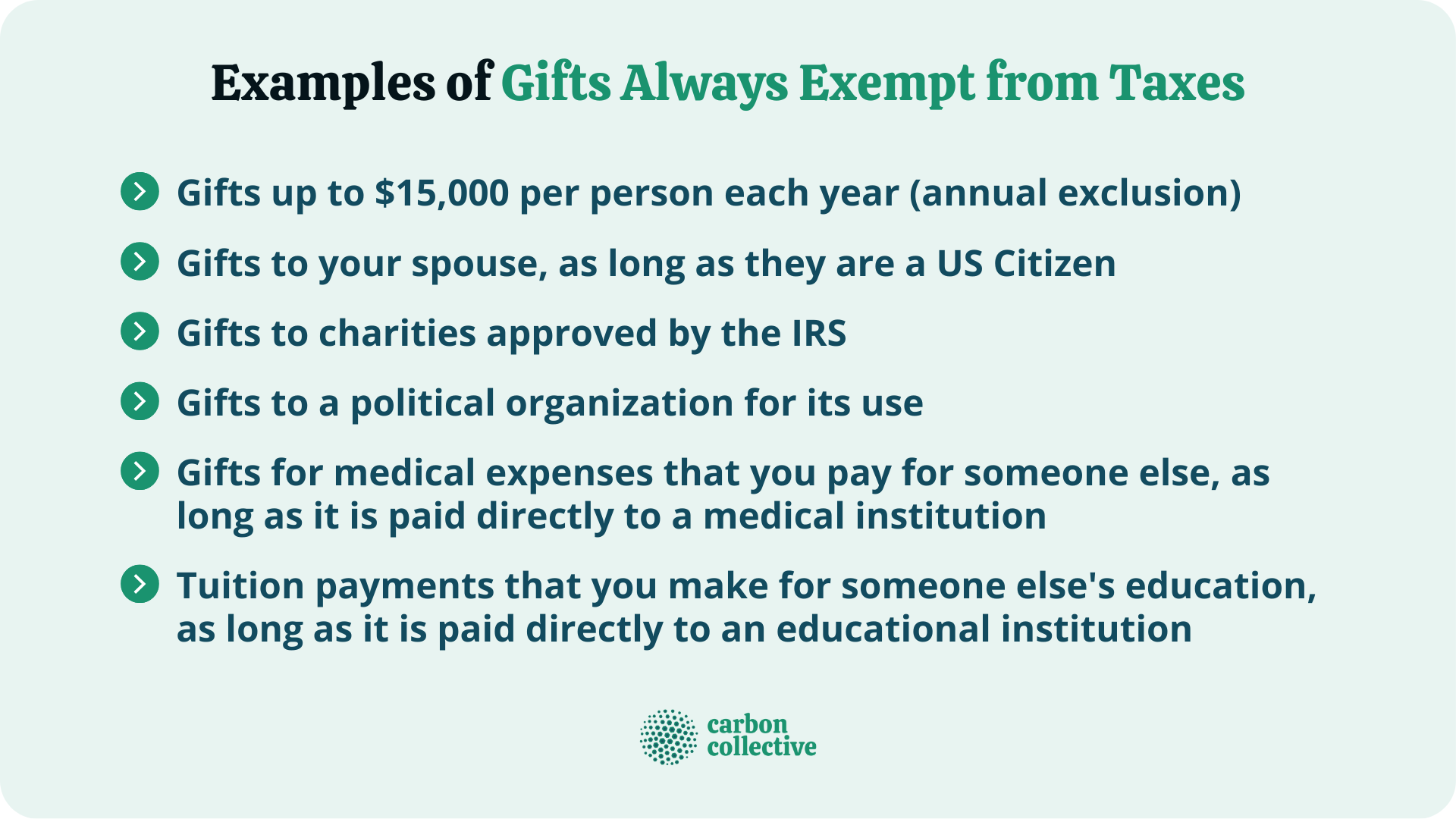

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, The irs has increased the estate and gift tax exemptions for 2025, along with adjustments to income tax brackets and capital gains rates.

Gift Tax Limit 2025 Married Filing Jointly Andi Marchelle, The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000 from the 2025.