Monterey County Sales Tax Rate 2025. The combined rate used in this calculator (9.25%) is the. Zip code 93923 is located in carmel, california.

Monterey is located within monterey county and. The 93940, monterey, california, general sales tax rate is 9.25%.

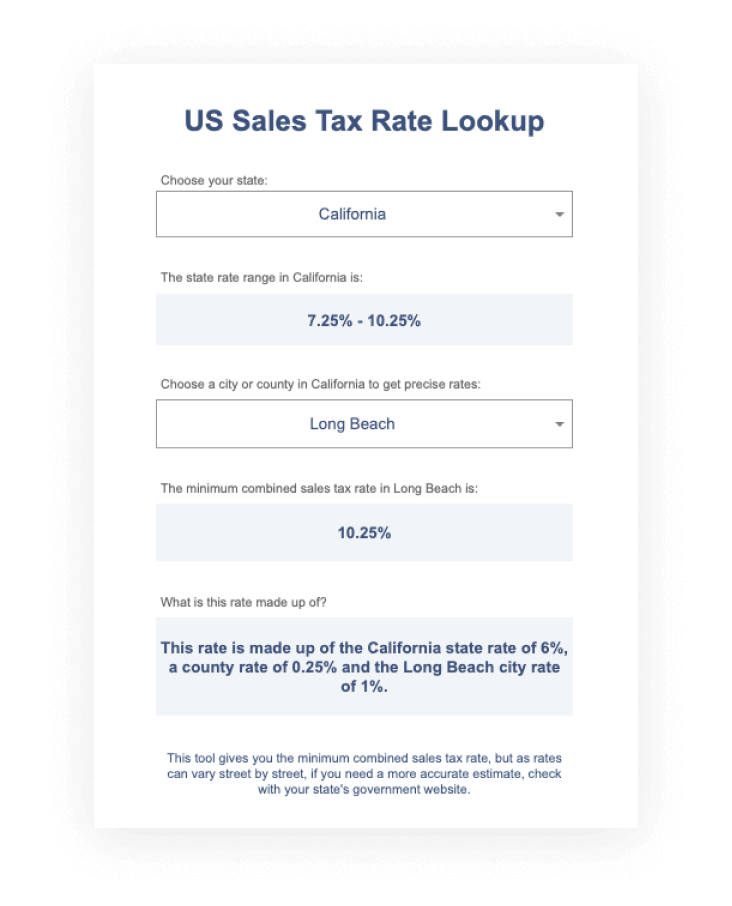

Iowa’s Local Option Sales Tax A Primer ITR Foundation, The monterey county, california sales tax is 7.75% , consisting of 6.00% california state sales tax and 1.75% monterey county. The current sales tax rate in monterey county, ca is 9.5%.

California Supplemental Tax Rate 2025 Wilie Julianna, The average cumulative sales tax rate in monterey county, california is 8.69% with a range that spans from 7.75% to 9.5%. Download all california sales tax rates by zip code.

NY Sales Tax Chart, The 93940, monterey, california, general sales tax rate is 9.25%. The current total local sales tax rate in monterey, ca is 9.250%.

Sales Tax by State 2025 Wisevoter, The monterey, california, general sales tax rate is 6%. This figure is the sum of the rates together on the state, county, city, and special levels.

California Sales Tax Rate 2025, The 2025 sales tax rate in carmel is 9.25%, and consists of 6% california state sales tax, 0.25% monterey county sales tax,. The sales tax rate in monterey, california is 9.25%.

USA GST rates explained Wise, For a breakdown of rates in greater. The december 2025 total local sales tax rate was also 9.250%.

Sales Tax Rates Nevada By County Paul Smith, For a breakdown of rates in greater. The current total local sales tax rate in monterey, ca is 9.250%.

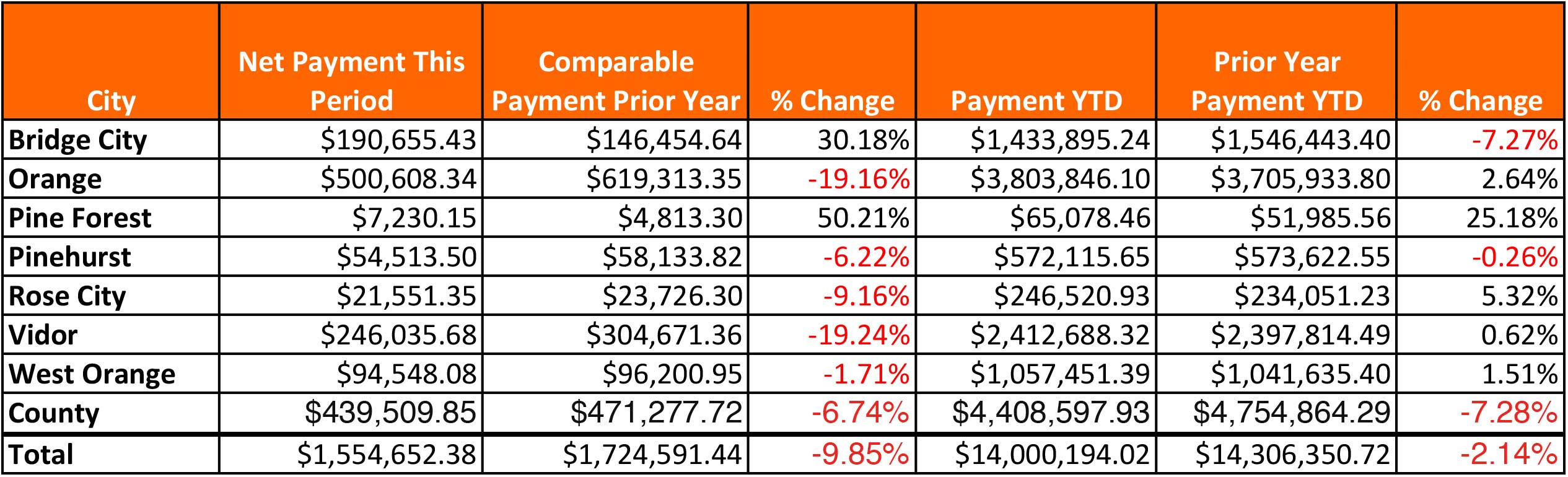

Sales tax down for most of Orange County Orange Leader Orange Leader, For a breakdown of rates in greater. Zip code 93923 is located in carmel, california.

monterey county property tax records search Marilu Hatfield, The combined sales tax rate for monterey, california is 9.25%. Depending on the zipcode, the sales tax rate of monterey may vary from.

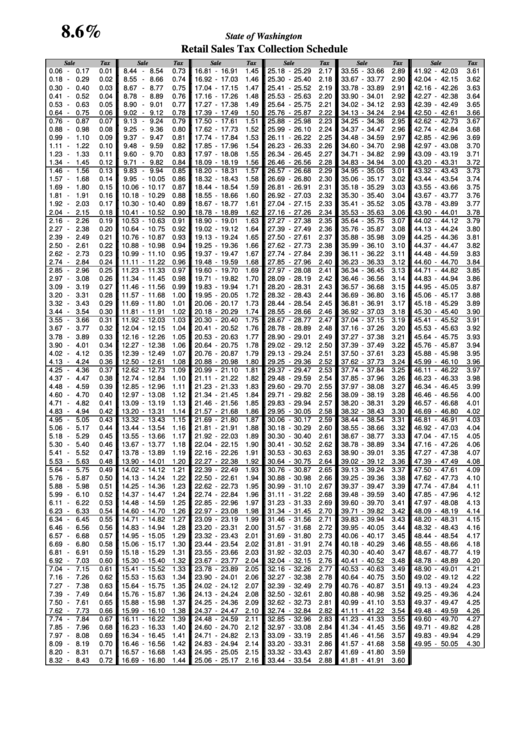

Printable Sales Tax Chart, The december 2025 total local sales tax rate was also 9.250%. The average cumulative sales tax rate in monterey county, california is 8.69% with a range that spans from 7.75% to 9.5%.

The sales tax rate in monterey is 7.5%, and consists of 6.5% california state sales tax and 1% monterey county sales tax.